Non Profit Tax Deadline 2025

Non Profit Tax Deadline 2025. Taxpayers can deduct charitable contributions for the 2025 and 2025 tax years if they itemize their tax deductions using schedule a of form 1040. Every year, estimated tax payment.

That’s when the tax agency began accepting and processing 2025 tax year returns. You may only receive either the sales tax refund or the property tax refund.

Us Tax Deadline 2025 Latest News Update, Here's what you need to know when filing your 2025 tax return. Every year, estimated tax payment.

3 Things You Need to Know About the July 15 Tax Deadline The Motley Fool, The tax refund office will calculate the refund for each tax, and you will receive whichever is greater. Key 2025 business tax filing deadlines in 2025 january 31st:

Non Profit Tax Preparation by NexGen Taxes, You may only receive either the sales tax refund or the property tax refund. Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small variations due to federal holidays and.

Tax Return Deadline 2025 India Printable Forms Free Online, Discovery shelving films as tax write. Are charitable contributions tax deductible?

Top 8 cách làm dateline mới nhất năm 2025 EZCach, 2025 federal tax deadline for. Are charitable contributions tax deductible?

Funding Love, Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small variations due to federal holidays and. Norway implemented the pillar two global minimum tax rules in the supplementary tax act, which became effective 1 january 2025.

State extends tax filing deadline to May 17, Taxpayers can deduct charitable contributions for the 2025 and 2025 tax years if they itemize their tax deductions using schedule a of form 1040. The summit county council approved the sundance institute’s $130,000 request after the nonprofit missed a separate deadline this spring.

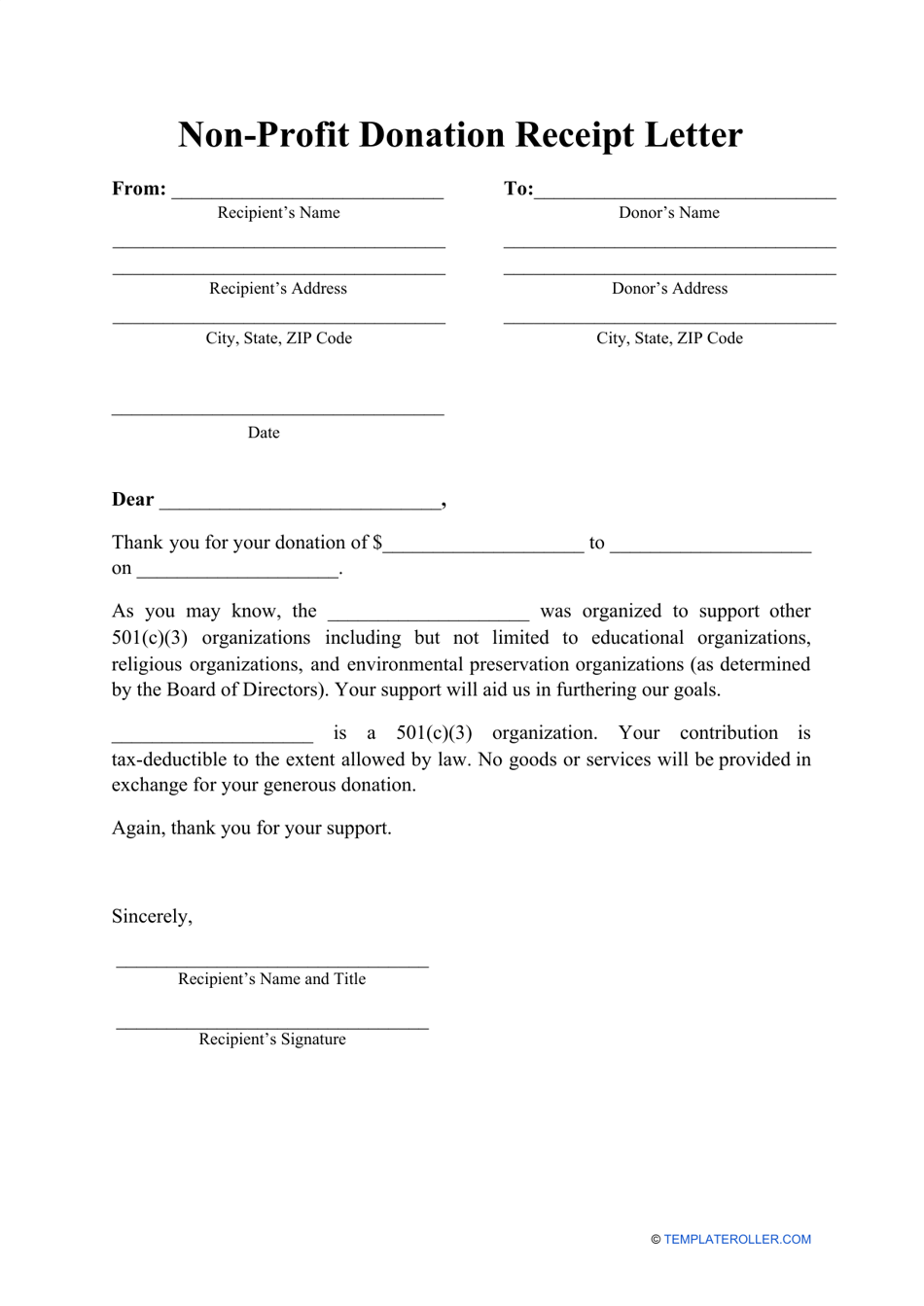

Non Profit Donation Receipt Letter Template, May 2025 tax dates and deadlines may 15, 2025. Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small variations due to federal holidays and.

15 Relatable (and Might We Add Funny) Tax Day Memes, Taxpayers can deduct charitable contributions for the 2025 and 2025 tax years if they itemize their tax deductions using schedule a of form 1040. Monday, april 30 —employers file form 941, employer’s quarterly.

Ursule Martin on Instagram “Don’t the deadline is on April 18th, Discovery shelving films as tax write. To use the table, you must know when your organization’s tax year ends.